The Financing Process

Demystifying Home Loans

Navigating the home loan process can indeed feel overwhelming, but with the right guidance and information, it can be a much smoother journey. Partnering with a trusted lender who understands your needs and preferences is key to ensuring a comfortable experience from pre-approval to closing.

It's essential to consult with mortgage specialists to find the best fit for you. By speaking with multiple professionals, you can compare options and choose someone you feel confident will provide you with the best care and support throughout the process.

By working closely with your lender and staying informed throughout each step of the process, you can navigate the home loan process with confidence and ease. If you have any questions or concerns along the way, don't hesitate to reach out to your lender for guidance and support.

Step One:

Get Pre-Approval

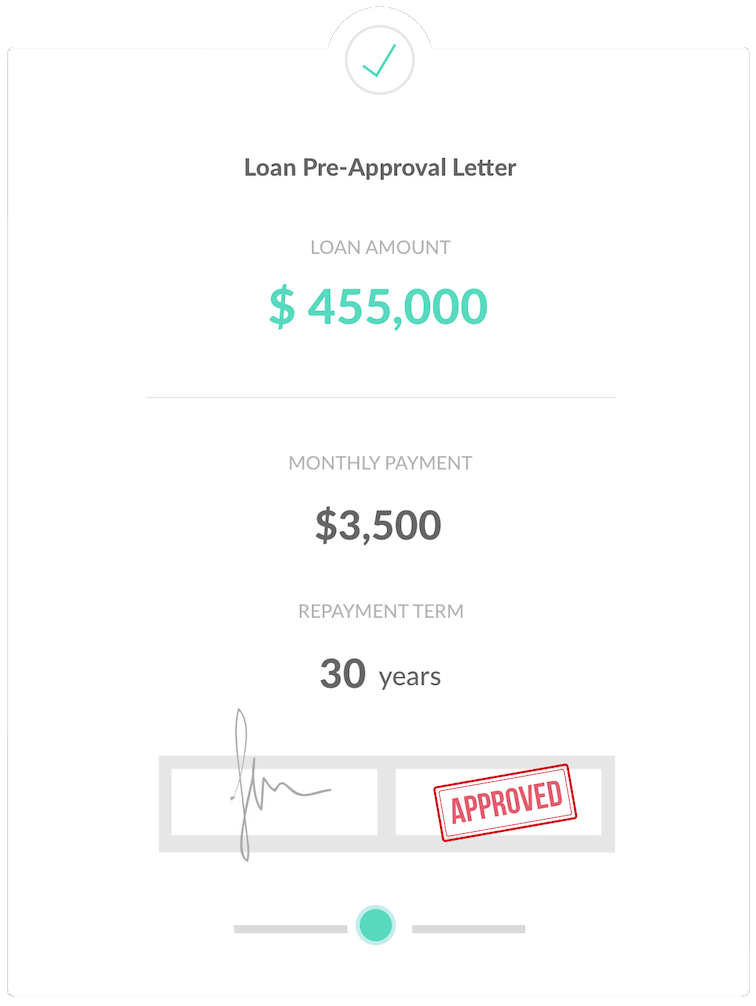

Before diving into your home search, it's essential to take the proactive step of meeting with a lender to get pre-approved for a loan amount. This not only gives you a clear understanding of your budget but also strengthens your offers in the eyes of sellers, especially in competitive markets with multiple offers.

During the pre-approval process, your chosen lender will gather crucial information about your financial situation, including income, assets, and debts. This data helps determine the maximum amount you can borrow. Be prepared to provide documents such as W-2 forms, pay stubs, federal tax returns, and recent bank statements. Additionally, the lender will typically run a credit report to assess your creditworthiness.

It's worth noting that there are various home loan programs available, each offering different advantages tailored to individual needs and preferences. Your lender will walk you through the specifics of each program, helping you select the best option that aligns with your financial goals and circumstances.

By obtaining pre-approval and exploring loan options upfront, you'll be well-equipped to navigate the homebuying process.

Estimate Your Monthly Payment

Estimate your mortgage payment, including the principal and interest, taxes, insurance, HOA, and Private Mortgage Insurance.

Price

Annual Tax

Loan Term (Years)

Down Payment %

Interest Rate %

Monthly HOA

Monthly Insurance

$3,198.20

Estimated Monthly Payment

Principal

$2,398.20

(75.0%)Taxes

$500.00

(15.6%)Private Mortgage Insurance (PMI)

$0.00

(0.0%)HOA

$100.00

(3.1%)Insurance

$200.00

(6.3%)

Step Two:

Find the best loan

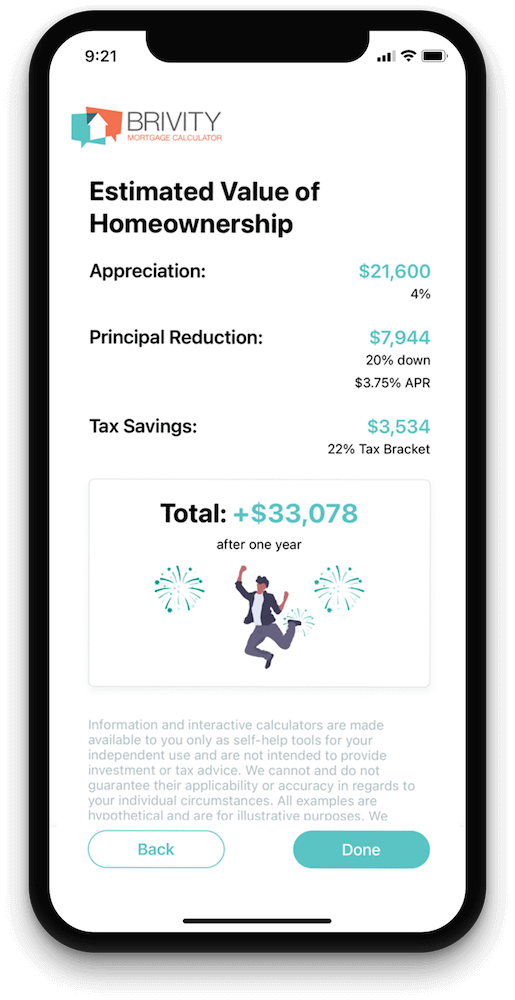

Collaborating with a knowledgeable and experienced local loan officer is crucial for accessing competitive rates and finding loan programs that align with your unique needs and goals.

To take the first step towards connecting with a top-notch loan officer, simply complete the form below. Once submitted, our team will promptly reach out to you to discuss your requirements and connect you with a trusted loan officer who can guide you through the mortgage process with confidence and clarity.

By completing this form, you're putting yourself on the path towards securing the financing you need to achieve your homeownership dreams. Don't hesitate to reach out – we're here to help every step of the way!

Step Three:

Application and processing

Once you've found the perfect property and your offer has been accepted, your lender will guide you through the next steps of the mortgage loan application process. This includes completing a full mortgage loan application, discussing various down payment options, and explaining any related fees in detail.

After your application is submitted for processing, the documents will undergo thorough review by the lender's team. Additionally, your lender will order a home appraisal and conduct a property title search to ensure everything is in order.

The application then moves to the underwriting stage, where an underwriter carefully reviews and approves the entire loan package to ensure it complies with all regulatory requirements and guidelines. It's not uncommon to receive requests for additional documentation or clarification during this phase of the application process.

Rest assured that your lender will be there every step of the way, providing guidance and support to ensure a smooth and successful mortgage approval process. If you have any questions or concerns at any point, don't hesitate to reach out – your lender is here to help!

Step Four:

Signing and finalizing the deal

Once your loan is approved, the next step is to set up homeowners’ insurance for your new property. This insurance coverage is crucial for protecting your investment and providing peace of mind.

Once your insurance is in place, your loan documents will be sent to the title company. The closing will then be scheduled, during which you'll sign all the necessary paperwork and pay any additional costs required to complete the purchase of your new home.

After the closing, the loan undergoes the required recording process, officially completing the purchase transaction. At this point, you become the proud owner of your new home, ready to embark on the next chapter of your journey.

Congratulations on your new home! If you have any questions or need further assistance during this process, don't hesitate to reach out to your lender or us for guidance and support. We are here to help make your homeownership dreams a reality!